Software as a Service (SaaS) has been the subject of some concerned deliberations in the last few years, with growth slowing down, multiples staying low and cloud delivery not being a source of differentiation like in the good old days. Another hot take that has been growing is that AI is eating software and SaaS in the way Marc Andreessen warned software was eating the world back in the day.

The latest wave of AI software is of course computationally heavy, so many of them have at least some component of pay-as-you-go, at least for heavier usage. This is the case for OpenAI, Antropic and Scale AI, for example. But SaaS subscriptions are still there, convenient and predictable for both companies utilising AI and otherwise.

A quick and dirty calculation based on Pitchbook data on VC-backed software companies in Europe would indicate that the share of SaaS deals has stayed relatively stable for the last five years: a nice and steady increase from 45% to 53% since 2018 (There are surprisingly many fintech and API-type deals that are not subscription businesses).

How about AI eating SaaS? Well, the share of AI deals has not increased massively either, although in the last few years an increase in the AI share of SaaS deals is clearly visible (Chart 1).

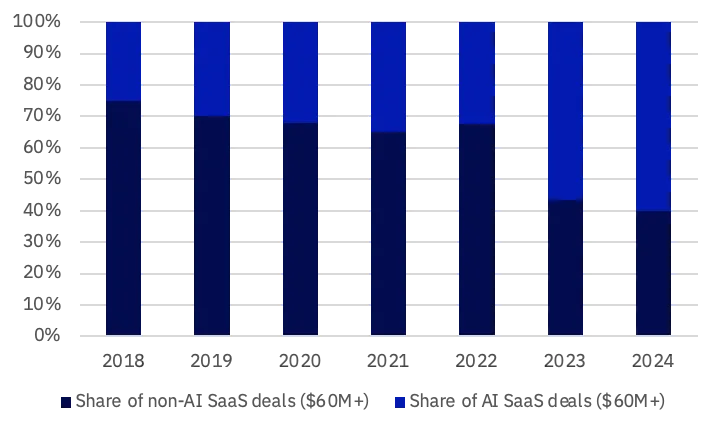

Now, zooming in, we notice that when it comes to larger rounds ($60 million and up), AI is actually gaining a significant share, especially in the last few years (Chart 2). Inevitably, this will trickle down to the earlier stages as the market will take note of later-stage investor appetite. Flipping the question around, it would seem SaaS is the most popular model for AI companies (around 70%), but for the larger deals it’s getting more uncommon, which makes sense due to the high costs associated with generative AI.

All in all, AI is rising for good reasons, and many of the companies in the space are doing great things. There is hype, but I remain a believer in AI's revolutionary potential. It's safe to say that most companies should and will utilise AI in one way or another. That being said, and perhaps a bit unpopularly, I dare suggest that a market still exists for sensible SaaS companies that are not necessarily AI-first.

PS. What constitutes an AI company in this “study”? Well, appropriately enough, I used a GPT plugin in my spreadsheet to classify the companies into SaaS and AI buckets (Sorry, Pitchbook; I don’t trust you). I actually spent some $10 bucks on tokens due to repeatedly shifting the cells in the spreadsheet and thus restarting the API calls, so I will not accept any criticism that my classification method might be flawed.