Written by Naureen Zahid, OpenOcean's Investor Relations Director.

Setting the (Macro) landscape

Geopolitical and macroeconomic factors rocked financial markets in 2022 and inflation soared across the globe.

This was driven, in part, by the level of unprecedented, co-ordinated fiscal and monetary stimulus enacted by western governments and institutions during the COVID-19 pandemic.

For the first time in history, payments by-passed the traditional financial systems and were deposited directly into the accounts of everyday citizens to honour promises of stimulus cheques and furlough payments; whilst simultaneously moratoriums were placed on rent, mortgages and student loans, easing financial conditions for the everyday citizen during a time of great uncertainty.

The pandemic period book-ended the ‘access to cheap debt’ era that was enjoyed by governments, corporates and retail alike.

Finally, geopolitical factors such as the war in Ukraine, and the weaponisation of sanctions and energy policy, came at a particularly delicate time to compound the effects of the already palpable fear, uncertainty and doubt.

The war between Russia and Ukraine placed significant strain on global supply chains that were already reeling from 2+ years of rolling shut-downs, and in keeping with geopolitically turbulent times, energy and commodity prices reacted as per the traditional expectation of ‘up-only’.

Things were not significantly better halfway across the globe, where China continued its state-enforced lockdowns throughout 2022, effectively hibernating in its role as the global workshop.

In short, this multitude of factors culminated in firstly driving increasing demand for goods, and subsequently increasing services demand, whilst supply was simultaneously constrained by either policy, availability of inputs, availability of labour and various other tangible and intangible costs.

It is difficult to know which was the proverbial “straw that broke the camel’s back”, triggering this inflation crisis, but what is clear is this has been a historically complex and turbulent time, perhaps on par with the post WW2 era.

Largest global exporters of natural gas

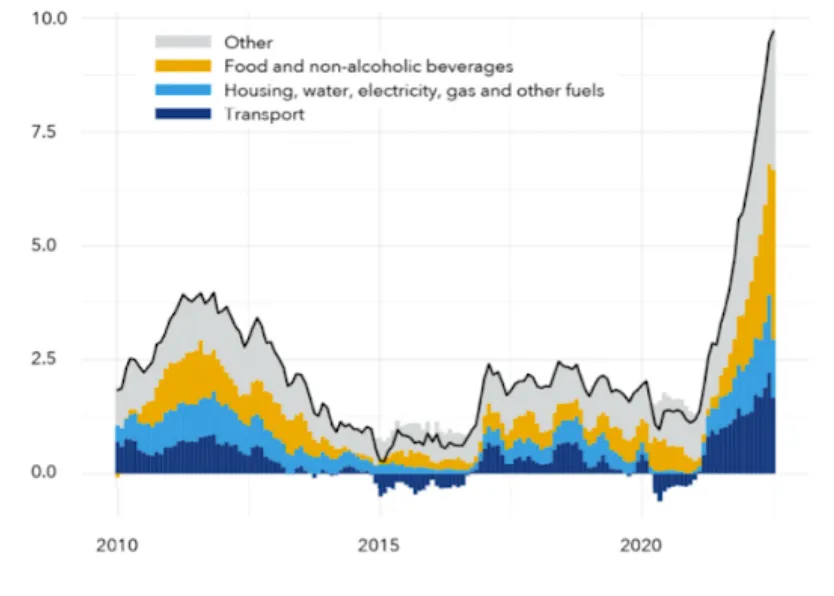

Inflation drivers. Food and energy prices continue to drive the global inflation surge (percent, median inflation rate)

During 2022 inflation peaked at over 9% in the US, and at 11.5% in the European Union, well above the 2% inflation targets. The Fed had been taking the stance that “inflation [was] transitory” when inflation started to rise in mid-2021, and failed to act quickly despite media and pundits calling for the Fed to move as the bond markets tightened fiscal conditions ahead of the Fed.

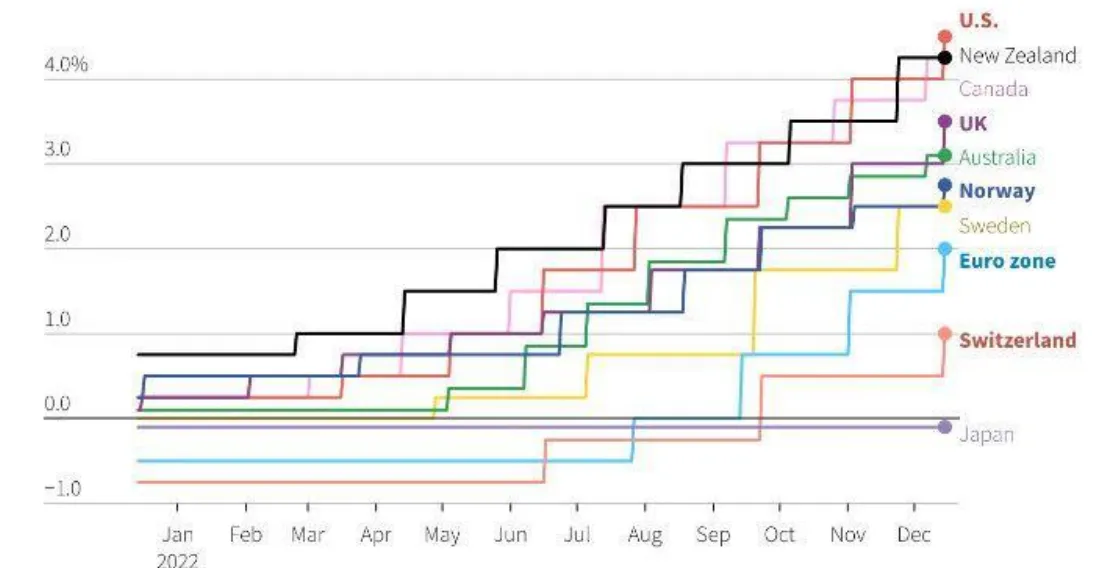

By Q1 2022 the Fed sprang into action to try and curb this soaring rise in inflation with the fastest and steepest rise in the Fed Funds rate than any time in modern history, as the view “inflation [is] transitory” was no longer tenable. These issues are not isolated to the US as similar movements have been seen across European bond markets, as well as the global commodity markets, causing these Central Banks to act and increase interest rates in response to these market movements and global surging inflation.

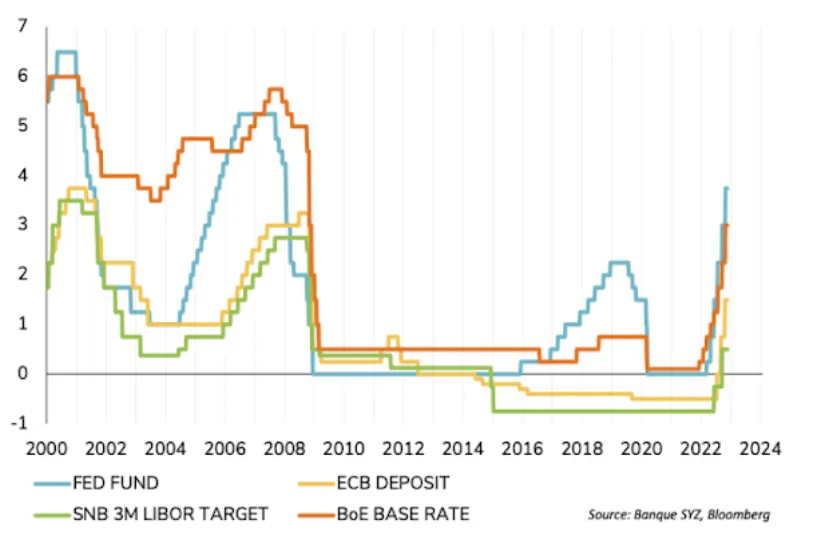

Interest rate figures across Europe and the US now sit at: 4.5% Feds fund rate, 3.5% BoE (Bank of England), 2.5% ECB (European Central Bank).

Central banks’ key rates 2000-2022

Central banks’ key rates moves of the 10 most traded currencies - 2022

Despite continued efforts to control inflation, it is proving to be stickier than either the Fed, BoE or ECB had thought. It is to be noted that there is strong debate amongst the commentators right now, one side adamant that inflation peaked in June 2022, whilst others are adamant that inflation is either sticky or will be a long-term cyclical issue facing western economies.

Impact on Public Markets Investments

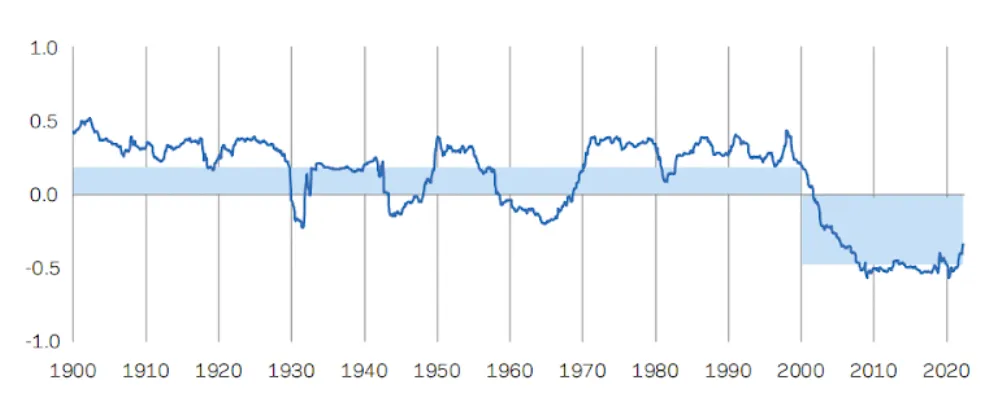

Institutional asset portfolios have traditionally adopted a 60/40 equity to bond weighting in which (for the most part) equities have been the chief return generators, whilst bond allocation have acted as diversifier to mitigate risk in their portfolios. This model has provided a negative correlation over the past 20 years, allowing these portfolios to rely on bonds at times when equities sell off to generate returns.

Rolling 10-Year Correlation Between U.S. Equities and U.S. Treasuries January 1, 1900 – March 31, 2022

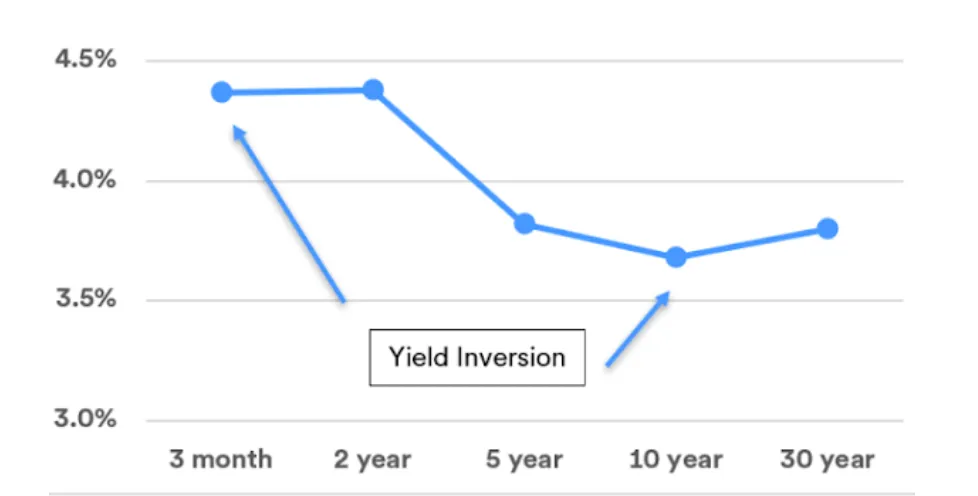

Since H2 2022, the bond market has been unsettled between inflationary and recessionary risks, however market participants are starting to lean in favour of policy error by the Federal Reserve, hence the inverted yield curve across all maturities in the treasuries markets, considered the safe haven “risk-free” holding. This significant yield curve inversion has caused further fear within markets leading investors to take a risk-off approach to protect from downside.

Whilst it is now expected inflation is beginning to ease, with a decrease seen recent prints in both CPI (Consumer Price Index) and PCE (Personal Consumption Expenditures) in the US, the effects of such hawkish moves by the Fed, and subsequently other Central Banks, are lagged in real-terms meaning we will begin to feel the real effects of these tighter moves in 2023. There are now real concerns for a recession in 2023.

The window for a soft landing has narrowed - Pitchbook’s quantitative model predicts a recession in late 2023 or early 2024 is more likely than not.

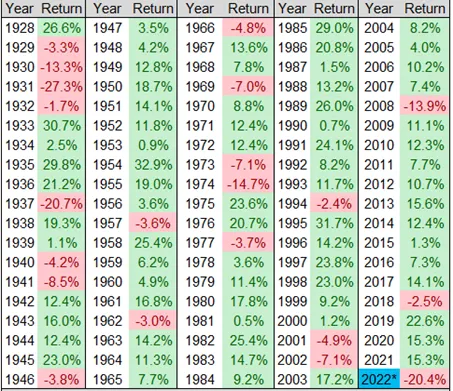

The 60/40 portfolio has responded to the market conditions of 2022 with the 3rd largest drawdown in recorded history at -20.4%, surpassed by only 1931 in which UK abandoned the gold standard leading to Black Friday, and a drawdown of -27.3%, and in 1937 during the Great Depression with a drawdown of -20.7%.

60/40 Portfolio: S&P 500/US 10-Year Treasury (Total Returns, 1928 – 2022)

As global supply chain pressures eased in 2022 with lockdowns lifting across the world, inflationary pressures continued. China moved to lift its lockdown measure from Q4 2022, a positive disinflationary signal, however, China has now seen soaring COVID cases in the region, meaning they are not out of the woods yet. The US is claiming that a tight labour market is causing inflation to persist in the US as unemployment figures are still low, but these are lagging statistics which can show dramatic turns without warning, especially when seasonal jobs and non-farm payrolls roll-off.

PCE is expected to persist at ~4% in 2023, 2 percentage points higher than the target. Whilst parts of the market are placing bets on an interest rate cut by the Fed by the H2 or end of 2023 to avoid recession or a prolonged recession, it is more likely that this higher interest rate environment will persist to bring inflation back in-line with the 2% target, rather than Central Bank’s validating a higher inflation target, which itself poses risks to markets.

Impact on Private Market Investments

The alternative and private markets have not been spared the volatility and drawdowns seen in public markets in response to the macro and geopolitical pressures.

This has further impacted investor portfolios as investors have increasingly been adding more private market exposure into their portfolios (via liquid and/or illiquid strategies) to diversify and balance their allocation to public markets, and to achieve absolute returns to supplement and hedge their equity and bond exposure.

Hedge Funds

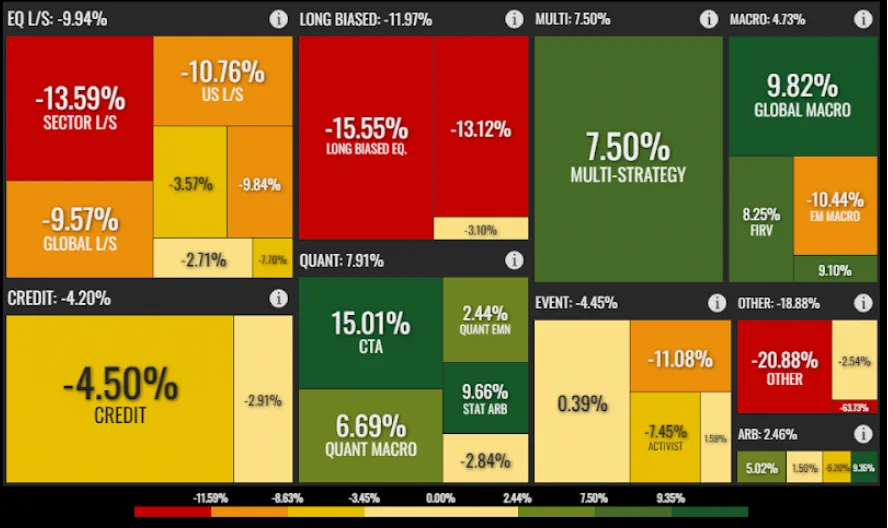

In the case of liquid private market exposure, hedge funds are expected to actively manage and capitalise on market moves of indices and selected bond and stock-picks, whilst using various hedging, leveraging and options strategies to secure absolute returns and win on arbitrage bets.

The hedge fund industry overall has seen drawdowns of -3.13% YTD; Macro, Multi and Quant strategies have managed to perform +4.73%, 7.50% and +7.91% YTD respectively, due to their exposure to the energy super-cycle and to commodities. Whilst these returns are lower than the double-digit returns these funds seek to deliver to investors, a positive vs. negative return in this market environment is welcomed by investors, however; with core inflation at 6% (US) and 6.3% (UK), stripped of inflation even the majority of the positive performing strategies are yielding negative returns to investors, and this is before netting yearly management fees.

Hedge Fund industry returns YTD 2022: -3.13%

It is to be noted that whilst the exposure to oil and energy has driven much of these returns YTD, the oil and natural gas market is now starting to see a decline amidst interest rate hikes and rising recession concerns, hitting the lowest levels this year in December 2022. This could erode a portion of the gains seen by some of these Managers.

Private Equity and LBOs

Investors with illiquid private equity market exposure would expect more insulated (than directly reactive) moves to the public market, and the expectation for capital to grow over the long-term with the ability to “ride out” negative market cycles. Whilst these investments are for longer terms with typical life cycles of 7-10 years, this does not insulate their investments from the negative impact of the current market environment with respect to the NAV of their holdings. As mentioned, although not directly reactive as public markets, asset discounts have now started to reflect into private market investments with the natural time lag of mark-to-market pricing of illiquid assets.

The environment of cheap capital following the recession of 2008-2009 has provided the perfect conditions for LBOs and PE to thrive and achieve the strong returns they have previously delivered, but this era of cheap capital has now come to an end.

Lenders are taking a more cautious approach to manage and control risk on their own balance sheets to satisfy and calm the nerves of their own shareholders, whilst still being able to distribute dividends. Those that are continuing to lend, either as investment banks or as private credit providers, are also demanding higher risk premia above the base rate which will ultimately eat into some of the returns these strategies are targeting.

After a historical period of low rates, 2022 has shown an acceleration in rate hikes, which the market forecasts to continue well into 2023 with an expected increase of another 125 basis points, to curb inflationary pressures

Deal activity has slowed in H2 2022 as GPs are taking a more cautious approach in response to current market conditions and likely being conservative with valuations; considerations of existing debt financing on the acquired company balance sheets, and the drivers of the bottom line growth of acquired companies, including:

- Reliance on retail consumers - with the current and projected increasing interest rates discretionary spending will likely plummet, as needed to suppress inflationary pressures;

- Reliance of raw materials for goods - which are still trading at inflated prices;

- Sales and operations channels (brick and mortar, staffing) - feeding operational costs on the balance sheet.

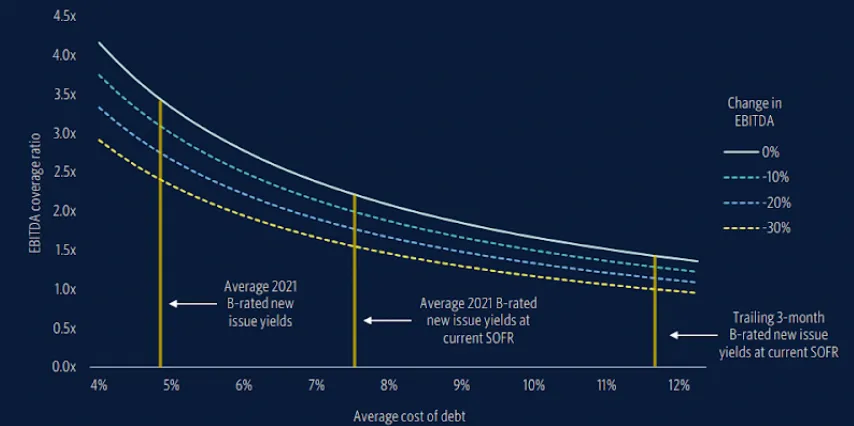

Sharp increases in the cost of debt to fund buyouts have driven interest coverage ratios lower, increasing liquidity risk, especially if earnings fall

In 2021 credit spreads were tight meaning the ratio of buyout debt costs:interest rate coverage were sitting very comfortably. A coverage ratio of nearly 3.5x was assumed for a starting leverage ratio of 6x EBITDA and the average 2021 B-rated new leveraged loan issue yield. Now that credit spreads are widening with rates targeting 4.5%+, liquidity risk in buy-out backed companies are rising. The interest coverage of 6x leverage ratio to trailing three-month B-rated new issue yields would only be 1.4x, a dramatic decline of 2.1x.

IPO and M&A activity has almost ceased in 2022 given the mark-to-market pricing and public drawdowns meaning LPs have looked to gain liquidity via secondary transactions of assets in order to meet their distribution requirements as an alternative to M&A or IPOs.

Private Equity exit activity has fallen sharply below both short- and long-term trends

The number and valuation of deals have declined since the recent market volatility as GPs adjust to these market conditions and form a strategy on how best to move forward.

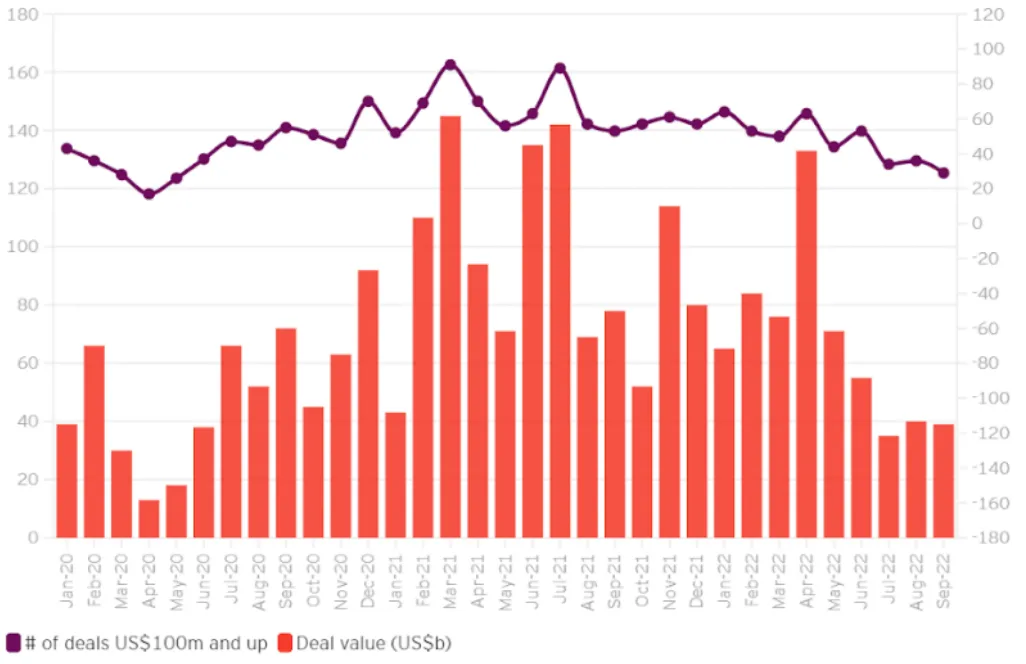

Global Private Equity Acquisitions by Month

Venture Capital

Venture Capital, particularly at the early-stage of the company life cycle, in which OpenOcean investments lie, is spared some of the large markdowns seen within Growth and later-stage companies as these companies are not as mature. However, even at this stage, both VC’s and start-ups have had to respond to these same pressures.

GPs are approaching investments with even more due diligence ensuring they back companies with:

- reasonable valuations;

- clear product-market fit;

- products which can be adopted in industries that can continue to grow despite this bear market.

Start-ups are having to be even more fiscally responsible and nimble to ensure they have enough runway to continue operations, growth and development, whilst securing and retaining income to survive.

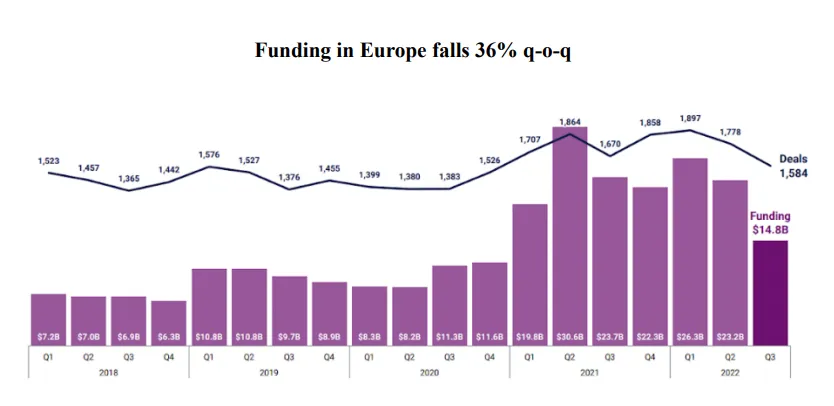

Like that seen in Private Equity and LBOs, the number and size of investments across late- and early-stage venture decreased q-o-q in 2022 in response to market conditions.

European Venture has also followed this global trend.

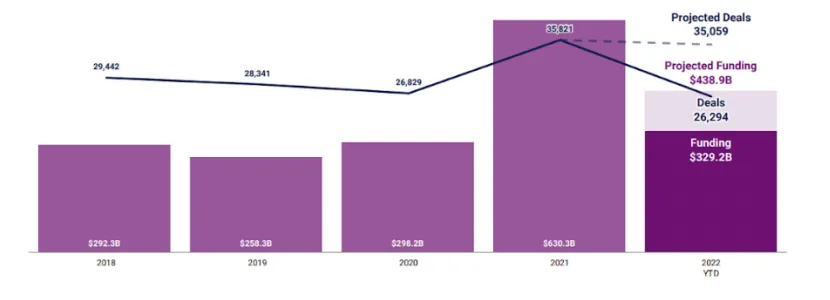

Although it is important to note the q-o-q change of 2022, over a 5-year horizon, 2022 YTD is still the second-best year with 35,059 projected deals at $438.9bn funding, running just behind the highs of 2021, and stacking up above 2018-2020.

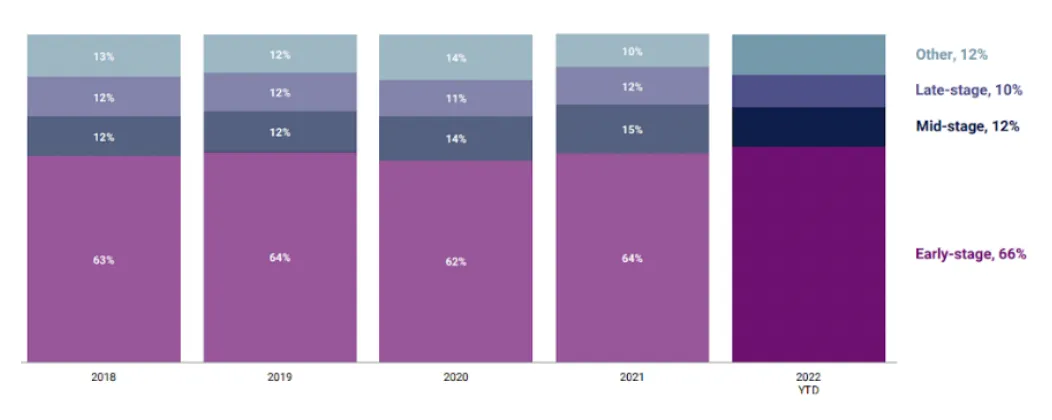

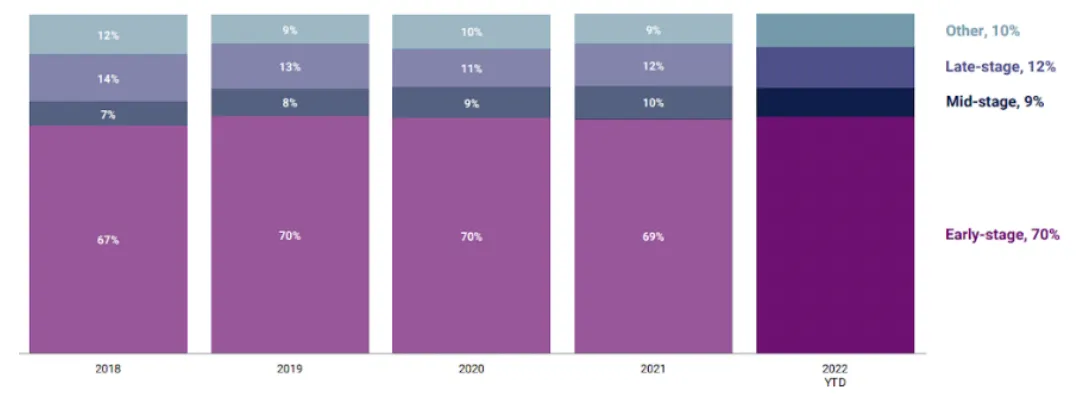

Early-stage venture has continued to be a key portion of this funding both globally and in Europe, as valuations come down in response to the market environment and GPs continue to see good investment opportunities, whilst approaching investments with caution.

Early-stage rounds continue to dominate overall deal share - globally

Early-stage rounds continue to dominate overall deal share in Europe

Markets generally move cyclically and investing in illiquid private markets allow investments to perform and grow across market cycles. Early-stage Venture has the added benefit of being able to invest in:

- new, emerging, and growing technologies with clear demand;

- start-ups with lean and nimble operations and strategy.

Despite the difficult year across all markets, the unicorn production rate, although declined, did not cease, and unicorns have continued to emerge.

Whilst Venture Capital relies less on credit facilities than LBOs and PE, debt servicing within start-ups and across Growth investments has been adopted by various companies to ensure enough runway to endure this market volatility as, at the right time, raising debt is cheaper than raising equity.

As with the PE and LBO market, secondary transactions and continuation vehicles are now becoming an alternative exit route for various funds to provide liquidity to investors to meet LP distribution requirements, rather than opting for M&A or IPO transactions in this period of market volatility.

2022 impact on GPs investment approach

At first glance, it seems that 2022 has been all doom and gloom, but many will argue this risk-on approach by the scarcity of capital that GPs are willing to deploy into individual deals (despite sitting on plenty of dry powder), compounded by higher competition of start-ups looking to secure this limited capital supply, has allowed funding rounds and valuations to revert back to pre-2021 levels. Some investors believe these valuations were overinflated, without justifiable basis, and this reversion of valuations was a long time coming.

The market environment of 2022 has also triggered GPs to once again adopt a conservative and highly diligenced investment approach, with increased scrutiny and tighter constraints for companies seeking capital to progress through the GP deal funnel for investment, as GPs are even more mindful of risk factors which can erode fund returns.

GPs are now back in a position to write more competitive term-sheets and apply covenants (where applicable) to ensure capital preservation and growth, and conduct further due diligence to ensure that only the best and most resilient opportunities receive investment. This will provide comfort to many LPs who are trying to rebalance their portfolios to try to make up for any shortfalls they have experienced, and to ensure future positive distributions.

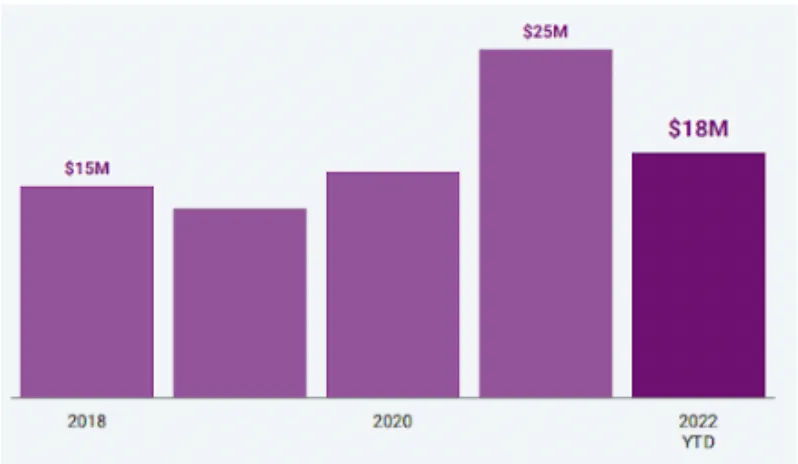

Average global deal size $18m

GPs will also likely be looking to target and double down on investments in sectors and verticals in which they have a strong track record of experience and success in order to generate fund returns in order to soothe LP concerns. With specialist managers, the investment strategy will likely remain the same; focusing on key areas in which they can leverage their strong technical understanding and expertise to pick the next generation of winners. Generalist managers may likely narrow their investment focus to only specific sectors and verticals which are able to survive in this environment.

For both specialist and generalist managers, success will be driven in verticals which can sustain demand and drive growth during times of volatility.

This year has tested both established companies and start-ups seeking to secure investment on their fiscal discipline and ability to react to the changing pressures applied to their respective organisations and markets, whilst generating revenue. GPs will need to analyse and be mindful of business and consumer budgets and spending, as both businesses and consumers are forced to tighten their purse strings and decrease discretionary spending in order to survive.

2022 impact on LP portfolios and allocation

Institutional LPs have been mandated to deploy capital and have a fiduciary duty to provide capital preservation and growth. This duty has not ceased despite the market environment seen in 2022, and to that which we are moving into in 2023.

As mentioned at the start of this document, many key traditional portfolio allocations have underperformed in 2022 meaning there are many LPs who have suffered losses and have sought, or will need to seek, liquidity to cover their losses and rebalance their portfolios.

12 Month Returns of key portfolio allocations

Leading global strategists forecast that this bear market and volatility will continue into 2023, and 2022 has shown that no part of the market, whether it be public or private, is protected against systematic risk. LPs will need to navigate 2023 with a more conservative approach to capital allocation and due diligence to deploy capital under their mandates to achieve their required portfolio returns for distribution.

Many LPs will be looking to rebalance their portfolios and allocations for 2023 to ensure they maintain enough liquidity and to cover losses they might have faced by the volatility and market turbulence of 2022, and that which is expected to continue into 2023.

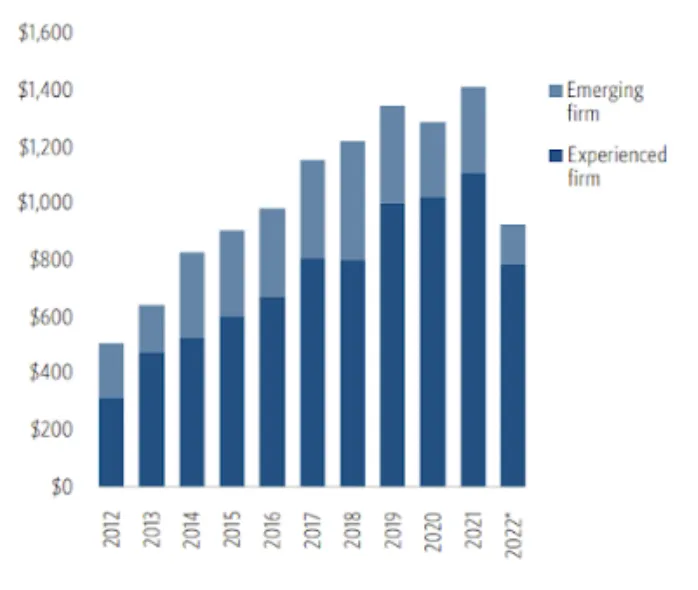

LPs will continue to require liquid and illiquid exposure to generate returns for their investors but will maintain a cautious approach to allocations throughout 2023. It is noted that many LPs are preferring to invest or re-up in experienced managers, whilst most now focusing on specialist managers over generalists as technical expertise and analysis becomes paramount in risk management and capital preservation.

Capital preservation is at the forefront of LPs minds and as such, LPs will seek to invest in managers who have delivered consistently strong returns across multiple market cycles or market turbulence, signalling prior experience and a track record in navigating market volatility and being able to generate returns.

Private capital fundraising ($B) by manager experience

Future and continued opportunities

Whilst understanding the current macroeconomic environment and its impacts on both public and private markets is essential to capital preservation, the pertinent question on LPs minds is where to generate returns for their portfolios and shelter from the volatility and large market drawdowns.

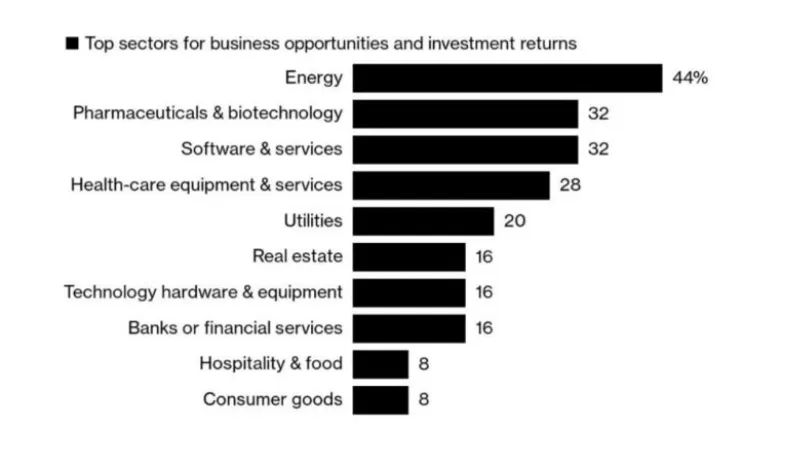

The results from a survey published in UBS’s Billionaire Ambitions Report 2022 has shown key areas where investors are seeking alpha, and exposure to Software & Services continues to be in the top 3 areas of focus.

Although it is noted that large tech players have seen considerable drawdowns in public markets, with the NASDAQ down -26.6% YTD, this is a direct correlation to the rising interest rate environment, and investor flight from growth to value investments as investors opt to reduce risk in their portfolios.

Growth strategies, in low interest rate environments, have yielded investors with exceptional returns, as seen by the NASDAQ 5-year return generating +60.65% and the survey suggests that this is still a key area for investments opportunities and returns, both in public and private markets. As inflation pressures start to ease in the future, central banks will again adopt a more dovish stance and interest rates start to come down, this will allow investors to increase risk in their portfolios and flock again to growth investing. Many investors, aware of this playbook, are choosing to buy-in now and hold, when prices are cheap.

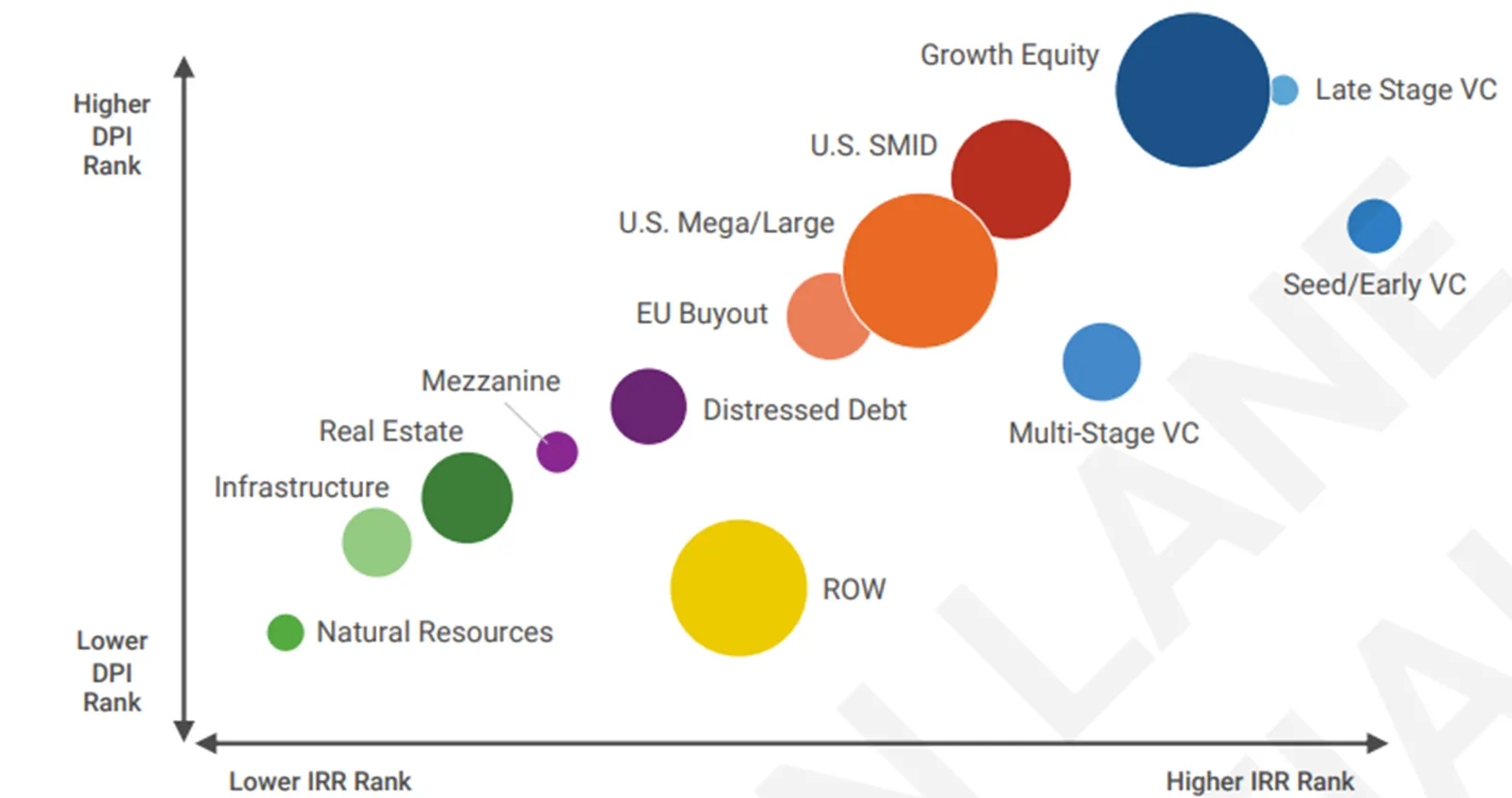

Institutional LPs will seek to continue allocating into key sectors forecast for continued demand, innovation, and adoption to deliver high IRR and DPIs, despite bear market pressures. Early-stage venture has historically delivered both high IRR and DPI to investors meaning it could continue to be a key opportunity for LP allocations to drive high portfolio returns.

IRR Rank vs. DPI Rank

Given market conditions, it is expected that experienced and specialist VC managers, focusing on essential business technologies are expected to prevail over generalist managers and those focusing on B2C or B2D models as discretionary spending slows down. It is expected businesses will focus on tighter fiscal discipline in order to survive and will allocate capital to adopt more lean and effective models of operation, whilst seeking less capital-intensive ways to increase productivity to drive profitability; ultimately cutting operational costs in order to maintain healthy balance sheets and enough runway to survive.

OpenOcean focusing on three substantial software areas

OpenOcean, from genesis, has been at the forefront of building and scaling market leaders in key and growing technology segments, globally. After successfully building global category leaders as operators, we have been active as an early-stage technology investor across Europe since 2011, with offices in Helsinki and London. Our General Partners collectively invested in over 40 companies, with a track record of successful unicorn exits delivering superior returns to our investor over the past 12 years.

As a systemic and highly researched investor, our investment focus in 2023 and beyond will be guided by three key thematic areas (detailed below) with a focus on enterprise software which can grow into B2B platforms. This is an area which we are confident will continue to grow both in demand and adoption, globally, despite these bear market conditions, and this is our focus to continue to deliver top decile returns to our investors.

OpenOcean’s DNA is rooted in our founding team members being the key persons behind MySQL AB (sold to Sun Microsystems Inc. for $1 Billion in 2008, subsequent acquired by Oracle). The team then jointly built category leader MariaDB Corporation Ab, which recently IPO’d on NYSE, one of the first European companies listed in the US as a SPAC, and formed OpenOcean in 2010.

Data Infrastructure

The market is stronger than ever, opening a $5 trillion opportunity for value creation over the next 10 years, and one which remains highly competitive with top cloud providers rapidly adding capabilities by M&A.

Hyper-scalers like Amazon and Google are dominating, but often fail in moving fast enough which creates an opportunity to build new global winners with multi-billion businesses and exits via an IPO similar to past success stories like MySQL, Snowflake, Crowdstrike, Confluent, Elastic, Palantir and C3.ai.

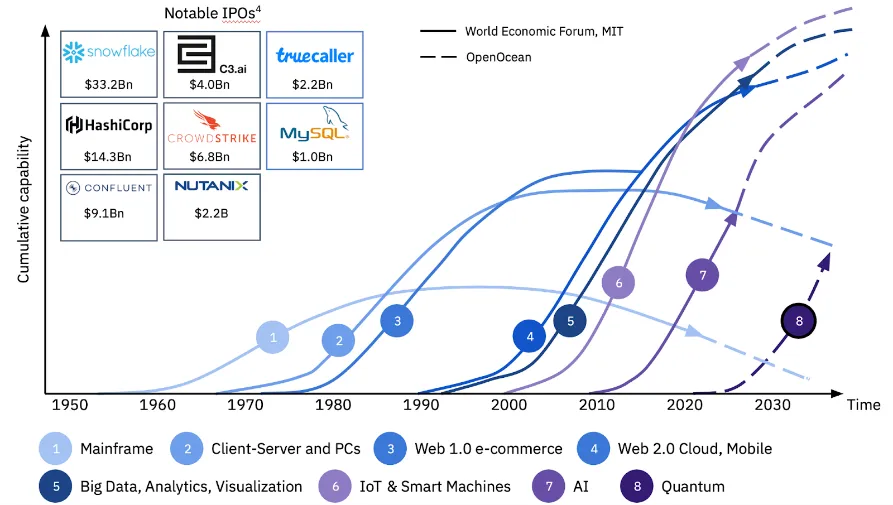

Emerging technologies’ waves continue to drive value creation and high returns

OpenOcean will focus on the following opportunities within this theme:

- Emerging Computing Paradigms to solve new real work problems like drug discovery.

- On-demand scale-out Infrastructure-as-Code to control the TCO and increase flexibility.

- AI: disruptive approaches to enable deployments at scale and broaden adoption.

- Cybersecurity shift to detection and response rather than protection.

- Data accessibility and debiasing of data for greater digital inclusiveness.

- Quantum’s emerging software stack to connect real world applications with the hardware.

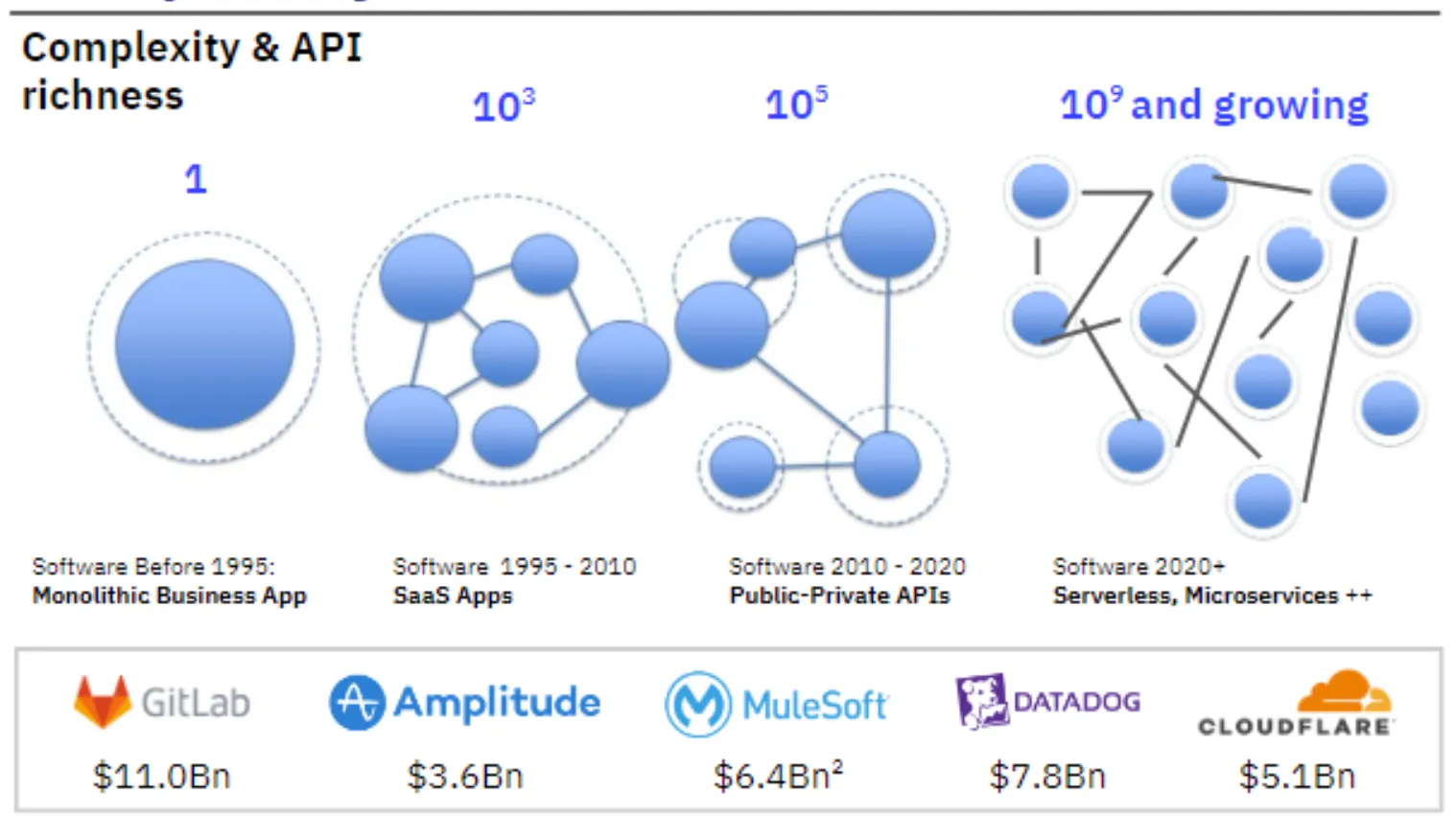

Future of Software Development

The world is changing to Software-first, opening a $1T opportunity in development tools alone. The value of the software development industry is increasing exponentially, with a market that is already valued at over $600B today.

Technology-first companies with stellar software development teams are overtaking the S&P and Fortune lists, with more than 550 new unicorns produced in 2021. For these companies to succeed, they need to rely on next generation software development tools, which today are struggling to keep pace with the speed of Software-first enterprise needs.

OpenOcean will focus to enable the best companies offering the best tools via the following areas in this theme:

- Low/no code application development tooling to address the shortage of developers while giving power to business owners.

- Securing the DevOps cycle grows in importance as there is an increasing reliance on complex 3rd party APIs.

- Platform Engineering is increasingly popular to empower collaboration among developers and increase efficiency.

- Open Source 3.0 with new business models emerging to decrease vendor lock-in and enable technology partnerships.

- DevOps new frontiers beyond CI/CD (Continuous Integration and Development) to address new environments such as mobile and multimode.

- New API architectures such as GraphQL are evolving to deal with limitations of REST.

- AIOPS is revolutionising the way software is developed and deployed with new approaches involving AI and Generative AI.

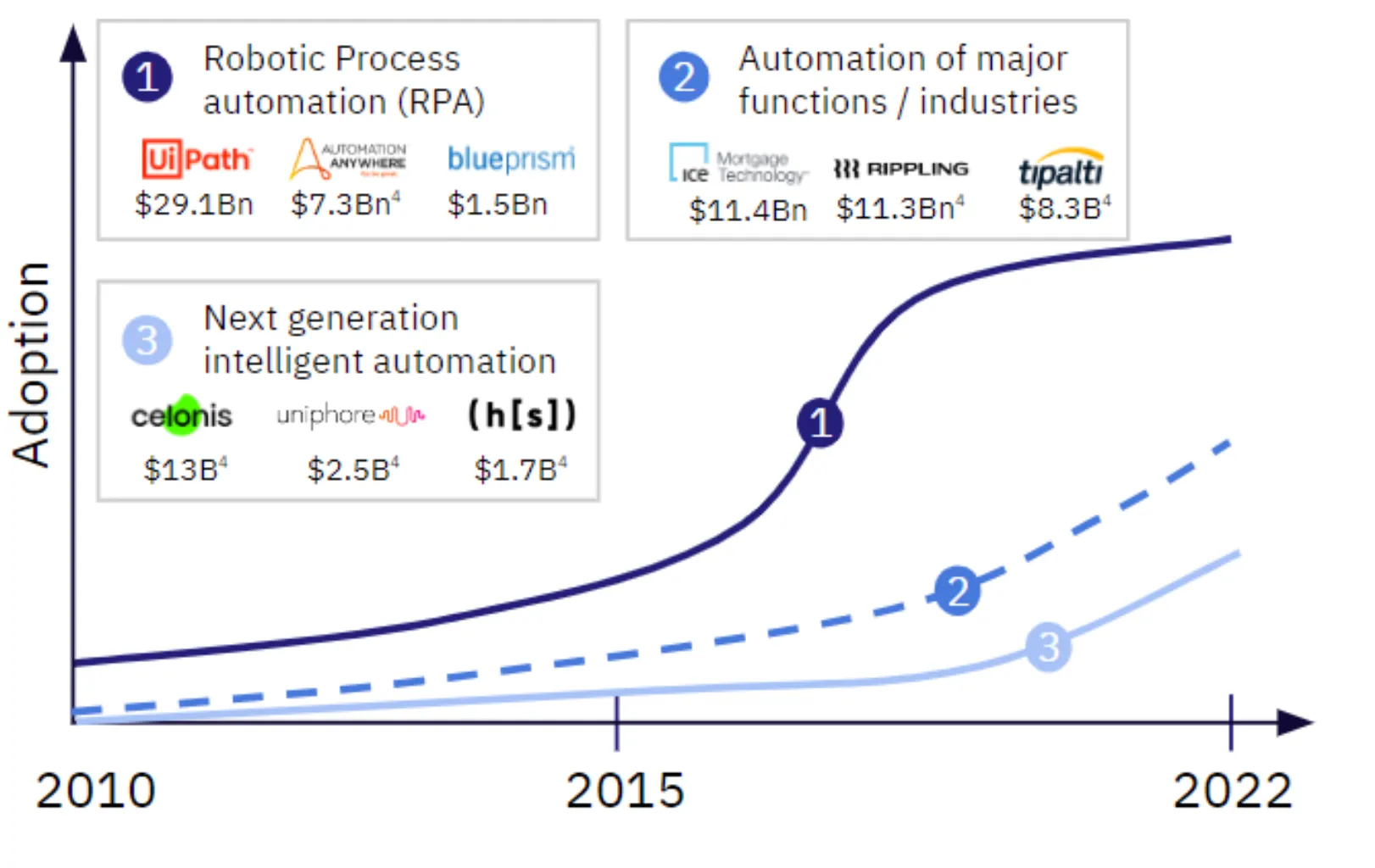

Automation

The market post-the initial Robotic Process Automation (RPA) wave is booming with fast growing gains, opening a $3 trillion opportunity for next-generation automation solutions by 2033..

Given the success of automating short rule-based workflows with RPA, there is now strong C-level pressure to identify new opportunities and increase investments. As existing tools were originally never built to design and automate complex workflows, it creates an opportunity to build new global winners similar to past successes like Celonis, ICE Mortgage Technology, Rippling, Tipalti and uniphore.

Maturing RPA market paving the way for new solutions

This will require enterprises to fundamentally change their approach to creating and managing automations, as well as reskilling of the workforce.

OpenOcean will focus on the following opportunities within this theme:

- Next generation intelligent automation:

- Real-time process intelligence to gain visibility of all manual and automated processes.

- Automation orchestration to manage and upkeep thousands of automated workflows.

- Use of AI and human-in-the-loop to automate increasingly complex workflows.

- Automation of major functions:

- Supply chain issues is one of the most challenging examples to be addressed with cross-functional automation tools.

- Automation of industries:

- Healthcare is an example of a vertical where we believe automation can drastically improve patient care despite staff shortages.

- Manufacturing is another area where automation will disrupt most of the processes in the coming years.

We hope you have found this analysis and market review helpful, and we welcome further conversation on our analysis and views. Should you like to discuss this further, please contact Naureen directly via email (naureen@openocean.vc).

Happy holidays!

Legal Disclaimer

The information contained has been prepared from original sources and data we believe to be reliable. Furthermore, it contains statements that are not purely historical in nature but are “forward-looking statements.” These include, among other things, projections, hypothetical analyses of income, yield or return and future performance targets. These forward-looking statements are based upon certain assumptions, not all of which are described herein. Actual events may differ materially from those assumed. All forward-looking statements included are based on information available on the date of this presentation material and there can be no assurance that estimated returns or projections can be realised, that forward-looking statements will prove to be accurate or that actual returns or results will not be materially lower than those presented. Therefore, undue reliance should not be placed on such forward-looking statements, and nothing contained herein is, or should be relied upon as, a promise or representation as to the future performance of investment.

In considering any prior performance information contained herein, prospective investors should bear in mind that prior performance is not necessarily indicative of future results. Prospective investors are encouraged to contact representatives of OpenOcean to discuss the procedures and methodologies used to calculate the investment performance information provided. Actual realized proceeds on unrealized investments will depend on, among other factors, future operating results, the value of the assets and market conditions at the time of disposition, any related transaction costs and the timing and manner of sale, all of which may differ from the assumptions on which the valuations reflected in the historical investment performance data contained herein are based. Accordingly, the actual realized proceeds on such unrealized investments may differ materially from the returns indicated herein.

OpenOcean makes no representations or warranty as to accuracy, completeness or reliability of the information contained herein (or as the case may be, the reasonableness of the assumptions on which they are based) and undertakes no obligation to update this document or to correct any inaccuracies therein.